Capital structured for the way your business operates.

Every industry runs on its own rhythm billing terms, seasonality, and the assets that keep operations moving. We help you prepare and choose an option that matches that reality, with clear trade-offs and practical next steps.

Industry-first decisions not generic offers.

Different industries. Same fundamentals: clear financials, a credible use-of-funds plan, and repayment logic that follows your cash-flow cycle. We tailor the approach to your sector so the decision holds up in day-to-day operations.

What shapes the right fit.

We tailor the path around the drivers that actually differ by industry not a generic checklist. We look at:

- Revenue stability and how predictable cash flow is across the year

- Margin consistency and whether you have buffer in slower periods

- Customer concentration and dependency on a small number of accounts

- Seasonality and the months where costs arrive before revenue

- Contract length and payment terms (including invoice timing)

- Operational capacity: staffing, delivery constraints, and execution risk

Once those points are clear, it becomes easier to map realistic options, set timelines, and avoid terms that create pressure later.

Select your industry to see a tailored path.

Explore common goals, typical routes, and what to prepare then speak to an advisor for the best fit.

Don’t see your sector in the tiles above? We also often support hospitality and food service, software and IT services, light industrial operations, and property services. If your business has a clear operating story and credible documentation, we can usually map a practical path.

Fast preparation beats fast promises.

A premium approval experience is usually about preparation: clean documentation, clear timelines, and a structure that matches your industry reality. We’ll tell you what to gather and why it matters.

What we typically request

This varies by product and case, but decisions move faster when you can quickly share:

- Basic company profile + operating history

- Recent financials (or management accounts)

- Bank statements / cash-flow view

- Project or asset details (quotes, invoices, purchase terms)

- Your timeline and intended use of funds

A clean process that adapts to each sector.

Same structure. Different details. That’s how you stay fast without turning it generic.

Initial conversation

We clarify your goal, timeline, constraints, and what a realistic plan should deliver.

Document checklist

We outline what to gather and help you present it clearly so decisions don’t stall on missing details.

Review & submission

We compare costs, terms, timelines, and trade-offs before you submit, then support follow-through to the next step.

Funding built around delivery and billing cycles.

Typical goals

- Stabilize cash flow between billing and payment

- Open a new location or hire growth talent

- Invest surplus capital with a clear risk approach

Align inventory, supplier terms, and seasonal demand.

Typical goals

- Finance inventory and smooth seasonal spikes

- Improve supplier terms and purchasing power

- Open new stores or expand online operations

Project-based funding that respects timelines and equipment needs.

Typical goals

- Acquire equipment and tools without cash-flow strain

- Bridge gaps between invoices and payments

- Fund growth into larger project scopes

High-value assets, careful compliance, and a premium patient experience.

Typical goals

- Upgrade or add medical equipment

- Expand practice locations or capacity

- Plan investment strategies around stability

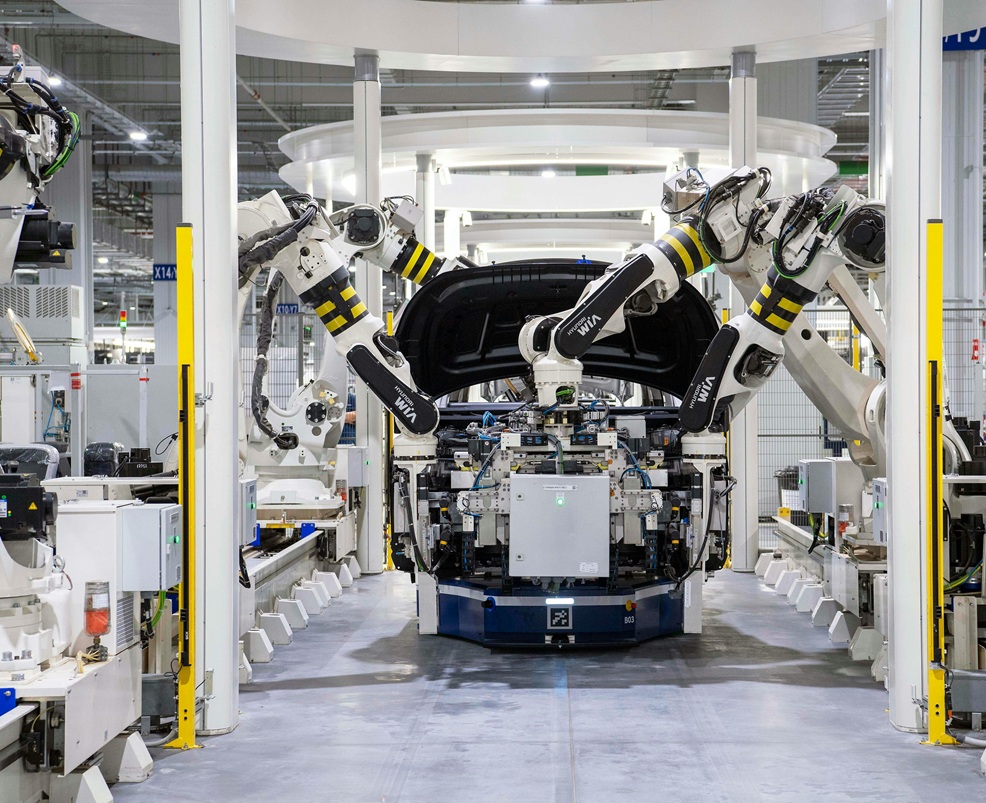

Structure CapEx and working capital around production reality.

Typical goals

- Fund equipment upgrades and production capacity

- Manage purchase orders and supplier schedules

- Build more resilient cash-flow planning

Acquisitions, renovations, and investment-driven timelines.

Typical goals

- Bridge funding for time-sensitive acquisitions

- Renovation capital and staged releases

- Investment planning around property strategy

Fleet, fuel, and trade flows structured for momentum.

Typical goals

- Fleet acquisition and replacement planning

- Working capital for operations and fuel cycles

- Trade-linked financing and smoother cash flow

Align funding and runway with billing cycles, delivery, and growth.

Typical goals

- Fund essential equipment and infrastructure without draining runway

- Plan around billing terms, renewals, and project milestones

- Choose terms that protect flexibility as you scale hiring and delivery